What Do Investors Look For Before Investing?

When serious investors are ready to move the investment conversation forward (past the initial niceties, the pitch deck, the first meeting, etc.), they will want to dig into the messy inside of your business.

These investors will usually start by checking out your “data room.” In ancient times (aka the 90s), a data room was an IRL conference room filled with paper files. Now, your data room can just be a digital folder in Google Drive, Dropbox, or your other favorite cloud storage app.

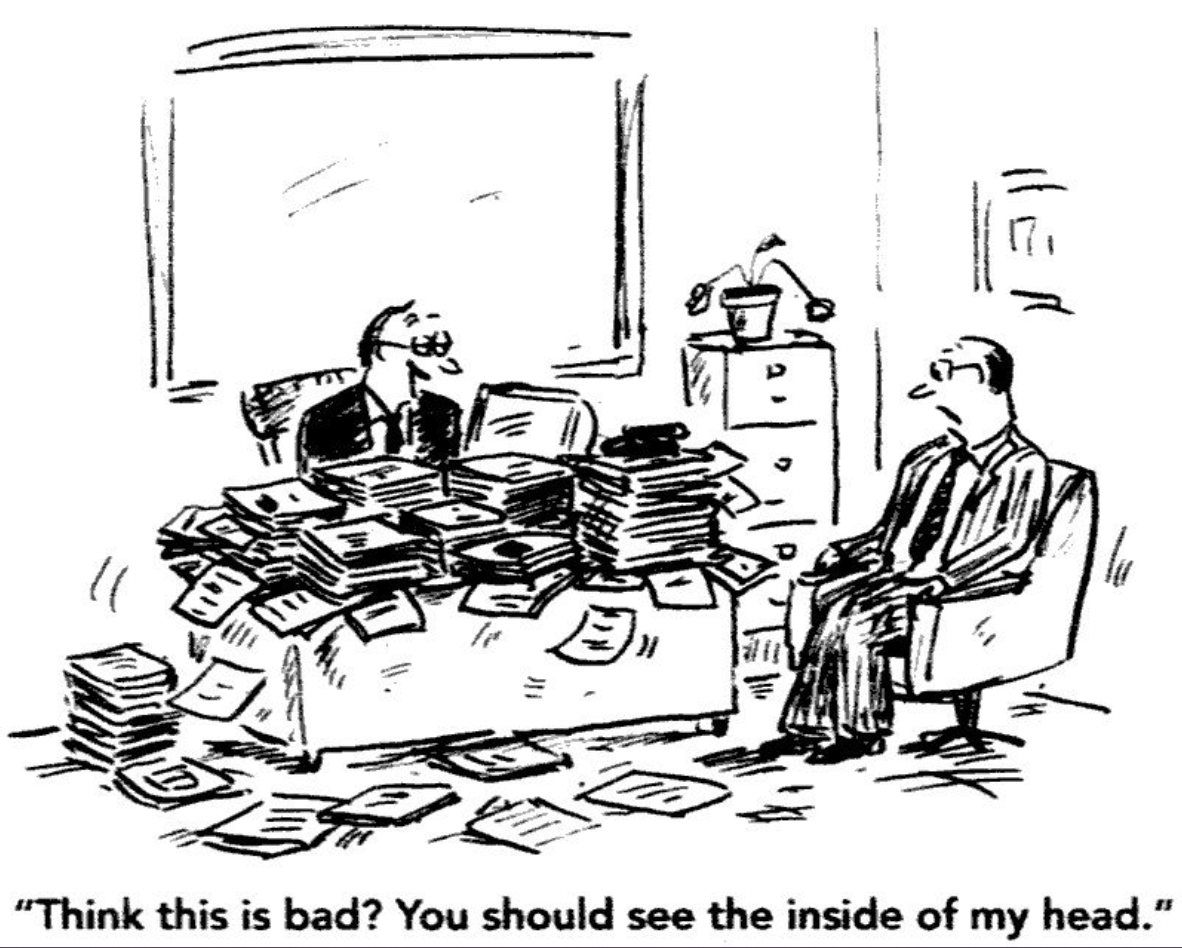

Very often, especially in the very early stages, these data room folders are a hot mess. You’ll see file names that don’t make sense, zero internal organization, random data, and lots of missing items. Yuck.

Worst of all, fair or not, the data room acts as a window into how you are running your business.

Your data room is a reflection of you and your startup. At the very early stage, there’s not much for angel or pre-seed investors to go on. So every shred of a clue into how a founder will build their business matters.

If your data room is a mess, I’m going to assume that you are running a haphazard operation. I’m going to assume that you aren’t doing a good job of controlling the things you actually can control.

In contrast, I have a visceral memory of the first time I encountered one particular founder’s truly well-organized data room. (Spoiler alert, we invested. Was this the only reason? No. But it helped build trust that this CEO was running a solid operation.)

Anyway, back to this gorgeous data room. It had numbered, clearly named folders. The organizational hierarchy made sense. There was even a table of contents! Angels sang.

In reality, it was just a simple Google Drive setup, but it made my job soooooo much easier. It wasn’t just well-organized. Their data room had all the materials I needed to see, and all my investor due diligence questions were answered.

Perhaps most importantly, the beautiful data room built trust with me that THIS IS THE WAY THIS FOUNDER DID BUSINESS. And that it was the way they would continue to do business, long after we invested. (Important, since it can take a decade or more until early investors see a return.)

There are hundreds of founders out there with great, venture-backable ideas. Execution is one of the big things that will set you apart, and effective organization is one hugely underrated way to prove you can grow and manage a multi-billion dollar startup. So show me you are great at execution, starting with your data room.

Return On Your Data Room Energy: A Better Business

A delightful side effect of building an organized data room is that it actually helps you organize yourself and your company. It’s like curating a coordinated capsule wardrobe out of a hopelessly messy closet.

It feels good, it looks good, and it helps you move confidently through the world.

I’ve built so many data rooms (as both a startup tech founder and a VC), and I’ve updated and refined them over and over. The data room is never truly done. It’s never perfect.

Still, it’s a useful, necessary tool, and if done right (which doesn’t even take *that* much extra effort), it can reflect what you want it to reflect: Someone who has their act together and will be a responsible steward of investor funds going forward.

And that’s what the Back It Up section of the Base Layer process will help you present to the world.

Introducing Base Layer, a strategic 1:1 advisory that goes beyond the pitch deck for startup founders raising their first investor dollars

Base Layer is a process designed to help you, a first-time startup founder, develop what you need under the hood of your business to attract investors, bankers and buyers.

You need to know how to create and protect financial value in your company because that's what investors, bankers, and buyers are looking for.

And you need to know how to move investors from “no” to “heck yes!”

This process is based on my 15+ years of experience working with diverse founders as a business attorney, startup founder, accelerator director, and venture fund manager.

I know Base Layer works; I’ve seen firsthand what it can do for the dozens of founders who I have personally supported using this framework.

I developed the first version of Base Layer (back then, known as Lunar Everywhere) in conjunction with Minnesota’s first inclusive accelerator, Lunar Startups, and our 77 amazing Lunar cohort companies. Base Layer has also supported our Tundra Ventures portfolio founders.

In addition to helping attract outside capital, Base Layer also helps founders:

Save money

Increase business survivability

Avoid common, business-killing mistakes

Impress business associates with founder savvy, and

Increase confidence and ability as a startup CEO.

The Base Layer Path To Impressing Investors: You Can Tailor The Experience To Your Specifications (Yes, It’s Like Creating Bespoke Long Underwear)

Choose Your Funding Path: A 10,000-foot view of available funding options and associated pros and cons. Select a funding strategy to fit personal and business goals.

Ownership & Power: Ensure legal control, develop a cap table, and understand how to protect personal assets. Create a setup that makes funders feel comfortable.

Lock Down Your IP: Discover how to prioritize and protect different types of intellectual property. Learn how to keep valuable IP from leaving with contractors & employees.

Back It Up: Learn about due diligence and how to build a solid data room for prospective funders (including financials, legal documents, market research, and more).

Make The Ask: Practical tools for getting more than just a first meeting. Covers meeting and follow-up etiquette, marketing materials, and stakeholder updates.

Because I’ll be providing 1:1 implementation support, we’ll prioritize the parts of the framework that are most urgent for your business while also ensuring we address every piece over time.

This is the kind of specialized guidance you can’t Google or get from ChatGPT. You and your business are unique, and you need personalized advice to navigate the always-dangerously-icy startup terrain. (It’s never summer in startupland.)

We’ll start where it’s most helpful and move at a pace that fits your timeline. You’ll also have 24-7 access to a searchable digital support platform.

Back It Up: What Investors Look For Before Investing

Investors aren’t just betting on your idea—they’re betting on your execution.

Before they invest a single dollar, they need proof that your business is organized, legitimate, and capable of delivering returns. That’s where the Back It Up pillar of the Base Layer framework comes in.

As we work together 1:1, we’ll arm you with the knowledge and tools to compile the documents, data, and financials that investors expect to see, giving you the best chance to secure funding.

What You’ll Learn From The Back It Up Section Of Base Layer

By working through this section of the process, you’ll gain a deep understanding of:

How investors are evaluating your company, and what they are looking for in a successful investment.

The key documents and information investors require to make an informed investment decision.

How to track and present your company’s financials in a compelling way.

The importance of due diligence and how to organize your data room like a pro.

What separates fundable founders from those who get passed over.

Your ability to “back it up” with strong documentation will influence whether an investor sees your startup as a viable opportunity or a nonstarter.

Let’s break it down step by step.

The Investor Scorecard: How To Attract Investors To Invest

Not all startups are investment-ready, and not all investors are a good fit for your company. Understanding how investors evaluate potential deals is crucial.

The Base Layer Investor Scorecard provides insight into what investors look for in founders and their businesses. This scorecard is exactly how we evaluate companies at my VC firm, Tundra Ventures, so it’s not just theoretical.

Some key factors include:

Team Strength & Commitment: Are the founders full-time? Do they have an unfair advantage, such as deep industry expertise or a powerful network? Have they worked together before?

Market Opportunity: Is your startup targeting a multi-billion-dollar market with the potential for a 100x exit? Is there any proof that this market exists or is growing?

Traction & Hustle: Have you demonstrated the ability to build, stretch a dollar, and turn water into wine? Are people paying for your product or clamoring to use your MVP?

Business Model & ROI Potential: Are your unit economics strong? Can you scale profitably? Would a large corporation want to acquire your startup one day, or could your business plausibly IPO?

Defensibility: Do you have intellectual property, a strong brand, or a moat that makes your business difficult to copy?

Investors want to know they’re backing founders who are coachable, resilient, and ready to go the distance toward a (multi) billion-dollar exit.

If you can’t check off most of the boxes on this scorecard, it’s time to refine your approach before stepping into the fundraising arena.

Due Diligence: What Documents Do Investors Need To Believe Your Business is Solid?

Before a sophisticated investor decides to invest, they’ll (almost always, lol) perform due diligence. Due diligence is basically a deep dive into your business to ensure everything checks out.

Founders who are unprepared for this process risk losing deals or slowing their fundraising.

To get ahead of the game, you’ll have access to my brain and Base Layer due diligence worksheets to help you gather key documents, including but not limited to:

Legal Documents: Articles of Incorporation, Operating Agreement, Cap Table, Privacy Policy, and Terms of Use.

Financials: Profit and Loss Statement, Balance Sheet, and Financial Projections.

Intellectual Property: Trademarks, patents, and agreements assigning IP to the company.

Contracts: Employee, consultant, vendor, and customer agreements.

Sophisticated investors will expect a higher level of due diligence than an angel investor writing a small check. The bigger the deal, the more thorough the due diligence process.

It’s hard to overstate how intense and time consuming a due diligence process can be, and how much stress a lack of organization can cause you and your team. You’re getting barraged by questions and requests for documentation, and if you don’t have the right materials ready you have to find or create them from scratch. I’ve been there, and it’s rough.

Knowing what to prepare ahead of time and having it ready to go makes your life so much easier. It also builds confidence for the investor conducting the due diligence process.

In addition to wanting to see that founders have prepared solid documentation, I always carefully watch how founders handle comms during the due diligence process. It’s a telling window into how they operate.

Are they responding promptly to requests?

Are they communicating effectively?

Are they able to connect me to their existing champions/investors? Are they acting with integrity?

Does what they’ve said to me so far match what I’m seeing inside the business?

Are they trying to bury red flags, or are they surfacing any issues and getting ahead of them?

All of this shows me how they will handle future fundraising ops. If company success depends on continually raising new rounds of capital, investors need to be confident that our portfolio founders can successfully raise over time.

Bottom line: Being well-prepared not only speeds up funding but also increases investor confidence in your ability to execute and continue to raise.

The Data Room: What Investors Look For In A Startup

A well-organized data room is essential for securing funding, especially in later-stage rounds. Think of it as a neatly arranged showcase of your company’s most important information.

Best practices for setting up a data room include:

Using a structured folder system (Legal, Financials, Product, HR, etc.).

Renaming files with clear, easy-to-understand names. No “final_final95_xlr-version3.pdf” nonsense.

Keeping it clean and polished. Investors will subconsciously (or consciously!) judge your competence based on how well-organized your materials are.

Presentation matters. An investor who opens a well-structured data room will feel like they’re dealing with a founder who has their act together.

A messy, disorganized folder? It’s an immediate red flag and makes the investor’s job harder. Plus, it has the potential to introduce doubt, which you DO NOT WANT. Doubt destroys early stage deals.

(Also, investors are drenched in a fire hose of information every day, so they tend to get crabby easily if it’s hard for them to access standard data and documents.)

Tracking Your Numbers: A Fundraising Due Diligence Checklist

1. What kind of bookkeeping and financial statements does a new startup need?

Investors will ask for financial statements. If you don’t have them, that’s a problem. Use standard software like QuickBooks Online to track income, expenses, and cash flow.

At a minimum, you need:

Profit & Loss Statement (shows revenue and expenses).

Balance Sheet (shows assets, liabilities, and equity).

2. What kind of KPIs should I be tracking?

Don’t run your business based on gut feelings. Instead, I can help you pick a reasonable number of Key Performance Indicators (KPIs) that measure your startup’s progress.

You’ll have access to a KPI scorecard that will help you define and track crucial metrics, so you can make data-driven decisions instead of flying blind.

Each business will have different KPIs, but some standard KPIs include:

MRR (Monthly Recurring Revenue)

Monthly Burn Rate (how much money you spend per month in your business)

Runway (Usually measured in months, and calculated by: Cash in bank / Monthly Burn Rate = Runway

Active Users (Daily/Monthly Active Users - DAU/MAU) – Measures product engagement.

Sales Cycle Length – The average time it takes to close a deal.

I like to have a few KPIs that you can 100% control (like sales calls per week), and a few that are critical but largely outside your direct control (like revenue).

3. What does basic tax compliance look like for a new startup?

These are the basics, and should be obvious but…many people mess this up. Investors will want to see a record of timely tax filings.

Stay ahead of tax obligations by:

Having someone who isn’t you doing your business taxes. Find a tax professional who focuses on small businesses to start with; you can upgrade to a larger shop if necessary as your business grows, but a smaller shop will be more affordable and right-sized to your business as it gets off the ground.

Applying for an EIN (Employer Identification Number) and a state tax ID if required by your state.

Paying quarterly estimated taxes to avoid penalties, if required.

Managing contractor payments and 1099 filings. 1099 deadlines are always in Jan & Feb, and for some reason kind of surprise me every year. Probably because I associate them with the April tax deadline. So do what I do - calendar some annual reminders and go from there.

This is just a benefit to you as a founder/stockholder, but consider filing an 83(b) election (if applicable) to minimize future tax liabilities on equity vesting. There is a strict 30-day deadline here.

4. What kind of financial projections do investors want to see from a startup raising their first round of capital?

Investors want to see where your business is headed. Your pro forma financials should cover the next 2-3 years and include things like:

Revenue projections based on reasonable assumptions.

Expected costs, burn rate, churn rate.

Growth milestones and fundraising needs.

A great financial model doesn’t have to be perfect. It just has to show you understand your numbers and have a plan.

I like to tell founders that the only thing you can guarantee about financial projections is that they will be wrong. So why do we want to see them?

Because we want to see your thinking, how granular you are, and how much you know about your industry, and whether you have missed any obvious considerations or are making overly grandiose claims.

Final Takeaways: What Do Investors Look For Before Investing?

The Back It Up section of the Base Layer process is all about making sure you have the documentation, financials, and structure to attract and secure investment.

When you’re organized and investor-ready, you increase your chances of landing the funding you need to grow.

By completing this section (with my help!), you’ll be able to:

Present yourself as a serious, investable founder.

Build trust and credibility with investors.

Streamline fundraising by anticipating investor requests.

Make data-driven decisions that keep your startup on track.

The best founders don’t just pitch well. They back up their vision with the right documentation and preparation.

Investors may love your vision, but they write checks based on proof. (Or at least the good ones do.)

This is your chance to give them the confidence they need to say yes.

If you made it all the way down here and you’re interested in premier protection from the icy winds of the startup tundra, here are some ways to dig in further:

Check out the next article in the Base Layer blog series: Your Stellar Startup Fundraising Process Starts Here (coming soon!)

If you missed the first four articles in the series, check them out:

Base Layer Overview: How Do I Get Investors To Give Me Money?

Choosing Your Funding Pathway: Sell The Right Vision

Ownership & Power: How To Run A Successful Startup

Lock Down Your IP: The Importance of Intellectual Property (And Why VCs Care)

Join the Base Layer Corporate to Capital Readiness Waitlist here

Follow me on LinkedIn